Spring Statement 2018: North East businesses react

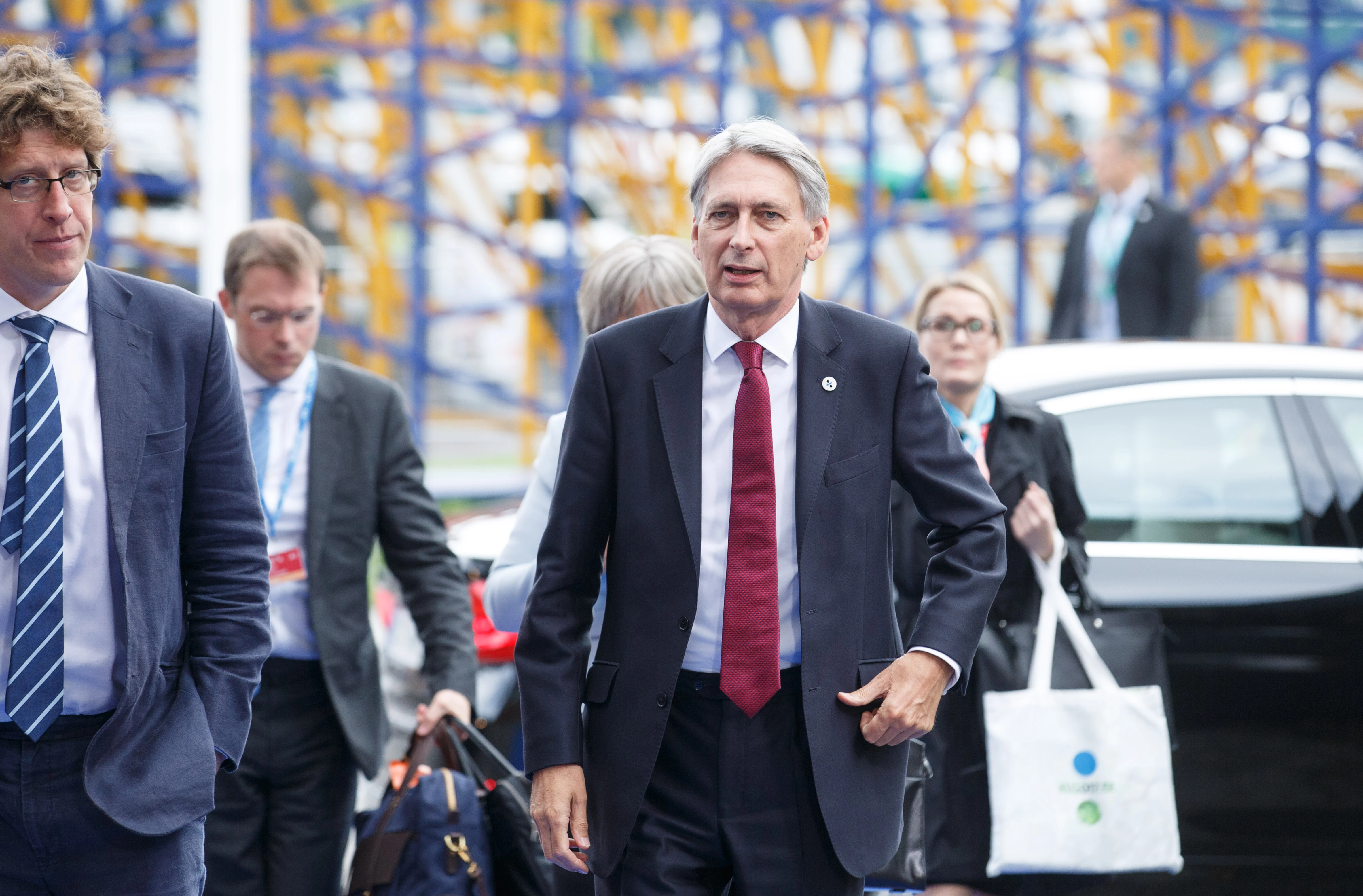

Today (March 13), the Chancellor of the Exchequer, Philip Hammond, delivered his first ever Spring Statement.

In the House of Commons, Hammond said that the country’s economy grew by 1.7 per cent in 2017. As well as this, the government is aiming to run a surplus on day-to-day spending in 2018/19, which should see it only borrowing for capital investment.

Meanwhile, the Chancellor spoke of hitting its borrowing target for 2020/21 with £15.4bn of “headroom”.

But what did North East businesses think about the speech, and is there really a “light at the end of the tunnel” as Hammond suggested?

Sandra Thompson, EY

Sandra Thompson is a managing partner for EY in Newcastle.

She said: “The figures in today’s Spring Statement underline what we already know - and indeed what EY’s own Regional Economic Forecast shows - that we are seeing a slowdown in economic growth across the UK, with the OBR forecasting a fall in GDP from 1.7 per cent growth in 2017 to 1.3 per cent in 2020.

“Our Regional Economic Forecast shows that in the North East we are predicted to have an annual GVA growth rate of 1.2 per cent to 2020, and investment in tech skills will be vital to maintaining our own trajectory.

“EY’s research clearly shows that the more a region is exposed to ICT (information and communications technology) and professional and financial services, the faster the growth tends to be, as those sectors continue to drive the economy.

“So the government’s commitment to investing more in digital initiatives, such as 5G test beds, is welcome but yet more is needed if this region and the country’s productivity growth is to be improved.”

Jenny Tooth, UKBAA

Jenny Tooth is the CEO of the UK Business Angels Associaton.

She commented: “Following the Chancellor’s Spring Statement, the UK Business Angels Association is pleased to see rising confidence in the UK’s overall economic climate.

“This sentiment is reflected through the actions of the UK angel community, with 41 per cent of angel investors investing more last year than in 2016.

“Further to the conclusion of the Patient Capital Review in Autumn 2017, it is heartening to see extensive new funds provided via the British Business Bank to enable regional businesses, many already backed by angel investors, to access the extra finance they need.

“While there is still a market gap for a connected supply of patient capital available to entrepreneurs across all of the UK’s regions, the UKBAA is seeking to address this by building capacity in the angel market through Angel Investor Hubs and comprehensive e-learning programme.

“The UKBAA welcomes the fact that, following Royal Assent on Thursday, angel investors will have a significant new opportunity to bring a further £1m investment per year to support knowledge intensive businesses.”

Paul Gibson, Active Chartered Financial Planners

Paul Gibson is the director and chartered financial planner at Active Chartered Financial Planners.

He said: “I was pleased to hear that the Chancellor was so positive about the current economic climate, describing a ‘light at the end of the tunnel’, which we will all be glad to reach.

“The growth of 1.7 per cent in 2017 is heartening, and is encouraging news in the absence of a spring budget.

“Although the statement was brief, I think the information demonstrates an economic position which is stable, and working well for people in the UK, especially those who are planning for their future. I hope this will continue, and that it will lead to positive changes at the Autumn Budget.”

Brenda McLeish, Learning Curve Group

Brenda McLeish, chief executive of Learning Curve Group, said: “While the government understands the value apprenticeships bring to the economy and creation of a sustainable and skilled future workforce, the Levy project has failed to deliver so far.

“However, the release of £80m of funding to help small businesses take on apprentices has the potential to in some way reverse the decline in new apprentice starts, but more needs to be done to transform the Levy into the workable solution it was envisioned to be.”

Gillian Marshall, The Entrepreneurs’ Forum

Gillian Marshall, chief executive of The Entrepreneurs’ Forum, said: “While the Spring Statement was light on detail, it was rich in intention, highlighting the importance of entrepreneurial businesses to the future prosperity of the economy.

“I hope that the Chancellor continues this into his Autumn Budget and spends some of the next few months enhancing measures such as EIS, Entrepreneurs’ Relief and R&D tax credits to bolster the growth potential of UK businesses.”

Mike Odysseas, Odyssey Systems

Mike Odysseas, managing director of Odyssey Systems, said: “Investments in technology and the wider Industrial Strategy will be crucial to the long-term success of the economy and crucial productivity gains the country needs.

“The £25m released to support 5G phone networks hardly came as a surprise and, quite frankly, isn’t near enough the kind of investment required. That level of investment wouldn’t give you a continuous call between two or three train UK stations!

“Super-fast broadband and mobile connectivity is becoming more and more important in the everyday lives of businesses, and needs to be given the same kind of attention as other infrastructure projects, such as road and rail networks.”

Brian Palmer, Tharsus

Brian Palmer, chief executive of Tharsus, commented: “This country has the skills and the determination to lead the way in many STEM disciplines, including robotics, but and we need to focus on cultivating that talent.

“The chancellor was right to emphasise the need for continued investments in technology, and I hope to see measures in the Budget in the Autumn to qualify that commitment.”

Michael Reid, Polar Krush

Michael Reid is a sales director of Ashington’s Polar Krush.

He said: “The government has stated its aim to follow up on plastic littering with a call for evidence to support on delivering reusable options and recycling.

“This is an issue that we are passionate about and as a company we are pleased that this issue is continuing to be addressed at government level.

“We are already one step ahead of the problem and have recently announced our company commitment to tackling this problem head on.

“Earlier this year we pledged to remove all single use plastic from our range by the end of 2018 and the first stage is to work with our clients and customers to offer refillable PAW cups, a favourite with children and a productive step to keeping our planet healthy and clean.

“We are already tracking this issue and will be working alongside the government and our clients to ensure that the commitment outlined by Downing Street is a success and that as a country we continue to decrease the amount of harmful plastic waste which is making its way into our oceans.

“From mid-March 2018, we will be offering cups, lids and straws made from a vegetable source called PLA, followed by development on a paper based spoon straw which is planned to become company standard.

“PLA looks and feels just like clear plastic but is made from corn, making it completely compostable with household waste.”

Dave Gibson, Blu Sky

Dave Gibson, director of Blu Sky, said: “As expected, the Spring Statement produced no fiscal changes and instead focused on more of a general update, and we expect the November Budget to focus on tax and spending changes.

“Overall, a pretty positive outlook was painted, with growth, job creation and an outperformance from what was predicted in the Autumn Budget.

“GDP growth is expected to continue over the coming years, and the OBR (Office for Budget Responsibility) has increased their forecast growth figure for this year.

“There was a mention of innovation, in particular with EIS investment reliefs and specifically around “knowledge intensive firms” where the company must have spent certain proportions of operating costs on R&D and either hold defined IP or employ “skilled” individuals to qualify.

“If they did qualify for this it means they would be able to raise higher amounts of EIS under longer time frames, which can positively impact a lot of new tech companies looking to raise!”

Professor Lawrence Bellamy, University of Sunderland

Professor Lawrence Bellamy, University of Sunderland’s Dean of the Faculty of business, law and tourism, commented: “Whilst the economic forecasts look encouraging, the growth figures are not as strong as peer countries.

“This is a confidence issue for UK PLC and may suppress investment, with companies in a position of ‘wait and see’ as the Brexit deal emerges. The North East has a great manufacturing base and needs to be sure that significant investments are going to be money well spent.

“Skills are on the agenda with the construction skills fund, ‘T’ levels and apprenticeships, important for the NE industrial economy, but investments remain relatively modest and the UK, it could be argued, is playing catch up with European neighbours.

“The apprenticeships initiative is rolling forward but SMEs are slower to pick this up, so some investment there is welcome. However these alone will not bridge the skills gaps which are at all levels and across many sectors.

“The North East is developing clusters of digital business, so the industrial strategy and contained fibre challenge is important to encourage this to be realised, the time taken to roll this out is critical.

“Large infrastructure projects have occurred elsewhere in the UK (e.g. Crossrail, Mersey Bridge) and whilst some money is available for road development Trans-Pennine routes remain problematic and weaken the Northern Powerhouse concept. This needs addressing.

“Manufacturing needs to move product round at lowest cost, so support for light logistics (with lower omissions) and the ongoing fuel duty hold are helpful. The largest actual cost though remains in delays due to congestion and incidents.

“We’re back to the infrastructure issue again and better connections for the North East.”

Looking to promote your product/service to SME businesses in your region? Find out how Bdaily can help →

Enjoy the read? Get Bdaily delivered.

Sign up to receive our daily bulletin, sent to your inbox, for free.

test article 123456789

test article 123456789

hmcmh89cg45mh98-cg45hm89-

hmcmh89cg45mh98-cg45hm89-

test456456456456456456

test456456456456456456

test123123123123123123

test123123123123123123

test xxxdiosphfjpodskhfiuodsh

test xxxdiosphfjpodskhfiuodsh

Savour the flavour: North Tyneside Restaurant Week returns for 2024

Savour the flavour: North Tyneside Restaurant Week returns for 2024

Six steps to finding the right buyer for your business

Six steps to finding the right buyer for your business

Stephen signs off on a special night

Stephen signs off on a special night

Life’s a Peachaus: Gillian Ridley Whittle

Life’s a Peachaus: Gillian Ridley Whittle

Making a splash: Phil Groom

Making a splash: Phil Groom

Making workplace wellbeing a priority

Making workplace wellbeing a priority

A record of delivery, a promise of more: Ben Houchen

A record of delivery, a promise of more: Ben Houchen