Ethical lender announces £40m investment to fuel growth and end “financial exclusion”

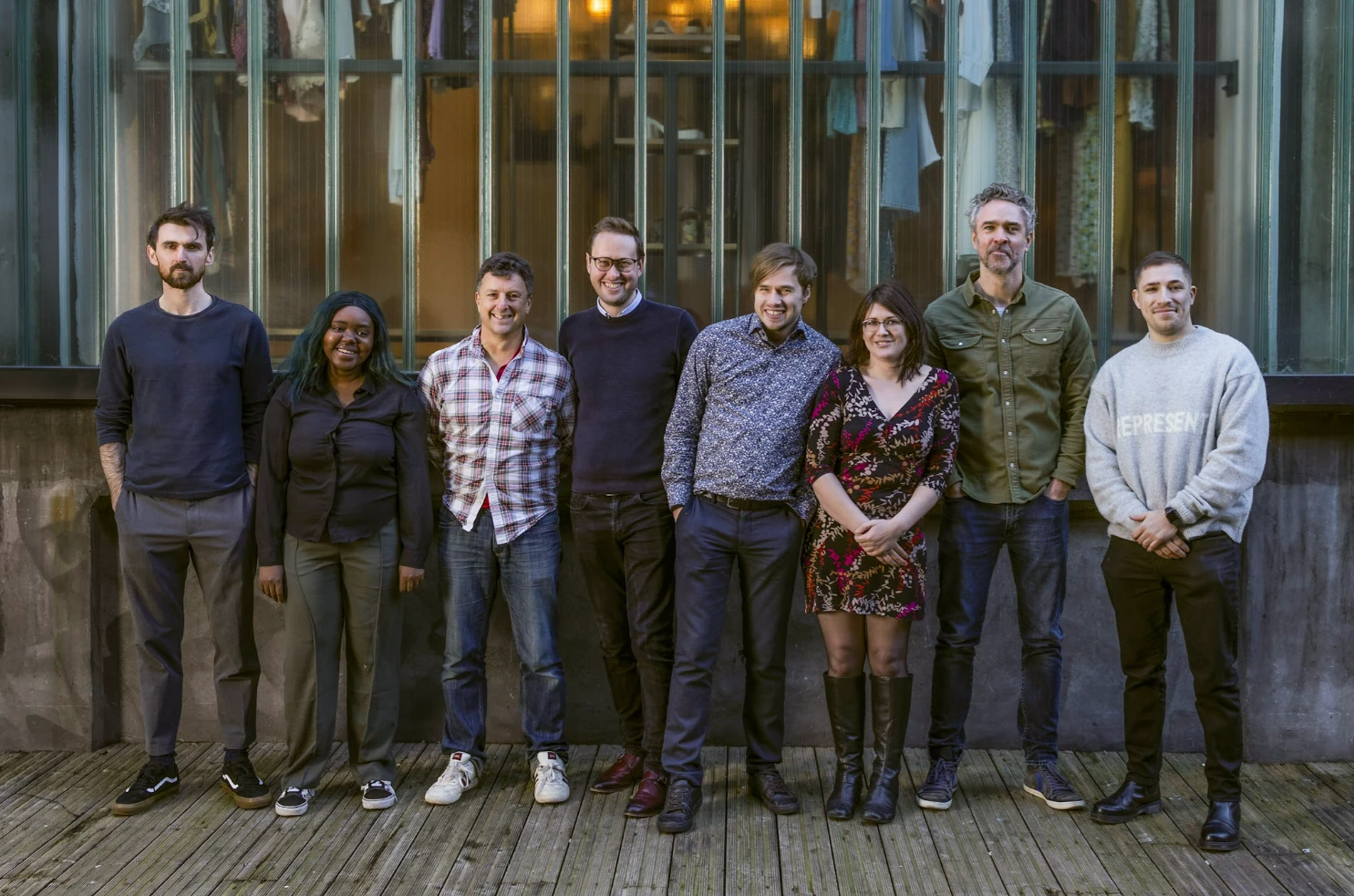

London based ethical lender Plend has announced it has raised £40m in seed funding with new investors including Leon & Soho House backers Active Partners, plus Velocity Juice, Sivo and the founders from Monzo, Starling Bank and Oodle Car Finance.

The seed round includes existing pre-seed investors: Ascension, Tomahawk VC, DD Venture Capital and Haatch who have doubled-down on their original commitments in the wake of post-launch growth and above expected loan performance.

The round is said to be a “vote of confidence” in Plend’s mission to rebuild the “outdated and backward” credit system, which the lender argues discriminates against applicants based on historic and limited data rather than what someone can truly afford.

The investment will be used to help scale the business into 2023, focusing on acquisition of new customers via new partners and reaching new audiences who find themselves excluded from the current credit system.

Following its launch in July 2022, over £40m of loan applications have been processed through the consumer lending platform and the loan book is increasing 20 per cent month on month. With the recent funding and newly formed partnerships with Monevo and ClearScore, Plend is ramping up to more than double its lending by end of year.

Plend enables wider access to “truly affordable” loans and so far has helped 70 per cent of its customers with debt restructuring as households across the UK search out better ways to manage their finances.

Plend also launched its first fully embedded ‘green finance’ product this year, supporting customers with low interest loans to purchase green energy installations such as solar panels and heat pumps via its partnership with MakeMyHouseGreen.

Rob Pasco, CEO and Co-founder of Plend, commented: “This new round of funding caps off an amazing year for Plend. Since launching our first affordable credit product to consumers this year, we have been able to help so many people get access to the money they need to get on with their lives at affordable and fair rates.

“We are thrilled to be working with our newest investment partners to provide a truly ethical alternative to the broken credit scoring system that locks so many people out of the market, especially during these times of economic turbulence and rising interest rates.”

Nick Green, seed investor at Active Partners, added: “We’re delighted to be investing in Plend. With their innovative technology, they are creating a fairer lending environment and improving the lives of many consumers currently burdened with high-interest loans.”

By Matthew Neville – Correspondent, Bdaily

- Add me on LinkedIn and Twitter to keep up to date

- And follow Bdaily on Facebook, Twitter and LinkedIn

- Submit press releases to editor@bdaily.co.uk for consideration.

Looking to promote your product/service to SME businesses in your region? Find out how Bdaily can help →

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning London email for free.

test article 123456789

test article 123456789

hmcmh89cg45mh98-cg45hm89-

hmcmh89cg45mh98-cg45hm89-

test456456456456456456

test456456456456456456

test123123123123123123

test123123123123123123

test xxxdiosphfjpodskhfiuodsh

test xxxdiosphfjpodskhfiuodsh

Savour the flavour: North Tyneside Restaurant Week returns for 2024

Savour the flavour: North Tyneside Restaurant Week returns for 2024

Six steps to finding the right buyer for your business

Six steps to finding the right buyer for your business

Stephen signs off on a special night

Stephen signs off on a special night

Life’s a Peachaus: Gillian Ridley Whittle

Life’s a Peachaus: Gillian Ridley Whittle

Making a splash: Phil Groom

Making a splash: Phil Groom

Making workplace wellbeing a priority

Making workplace wellbeing a priority

A record of delivery, a promise of more: Ben Houchen

A record of delivery, a promise of more: Ben Houchen