Partner Article

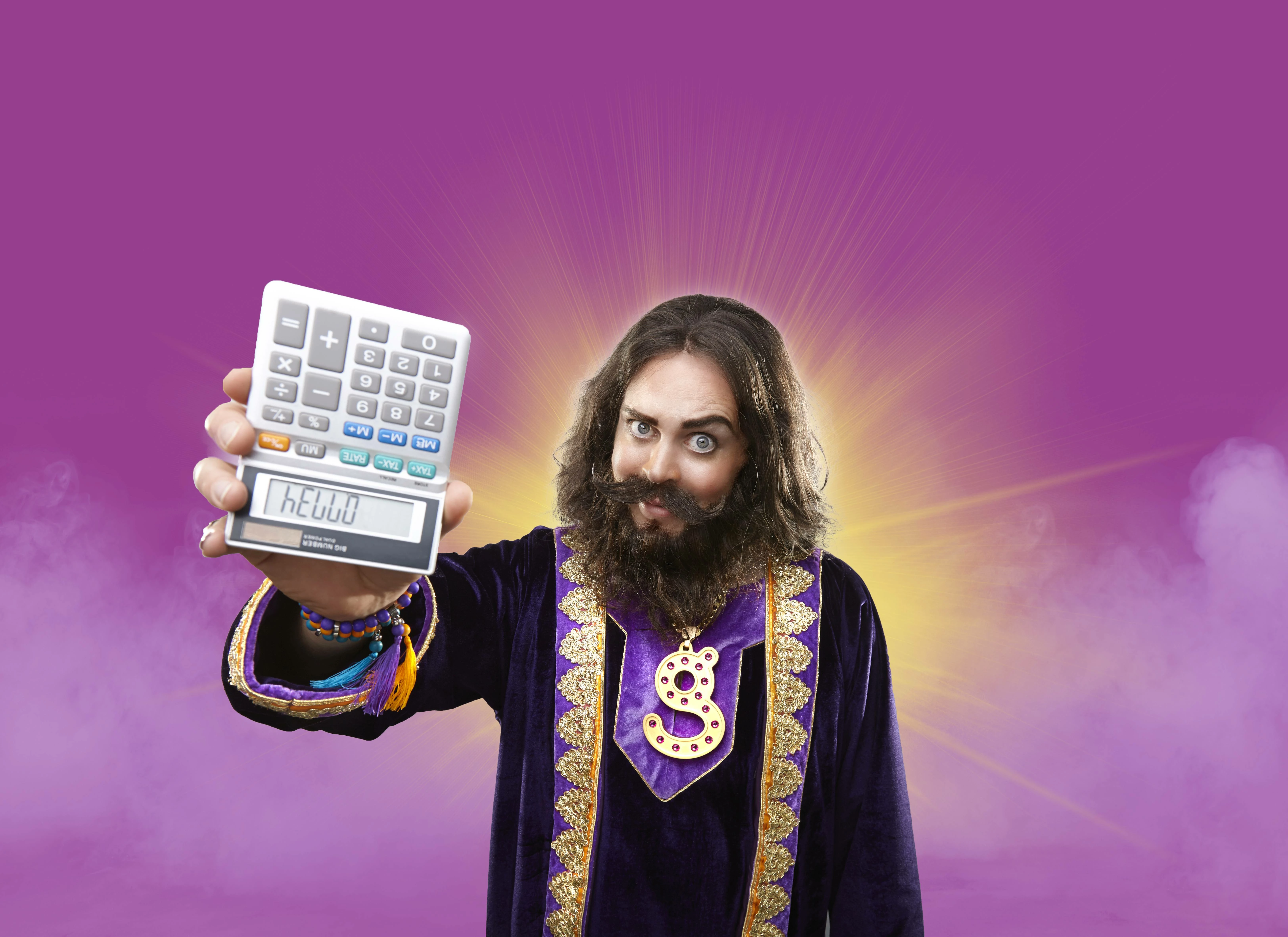

MONEYGURU.COM ANSWERS YOUR TEN MOST GOOGLED FINANCIAL QUESTIONS

GOOGLE really is the place to go if you have a burning questions. A recent list of the most Googled questions in the world included ’‘How to lose belly fat?’, ‘How to tie a tie?’ and heartbreakingly ’How to kiss?“, but what are people asking Google when it comes to money?

The experts at moneyguru.com are here to answer those go-to Googled questions and share their financial wisdom:

1. How to make money? If you have a steady income and spend smartly, you’re on the path to making money. The trick is pretty simple, just make sure you’re spending less than you earn, which will help to slowly build up those extra pounds. Anything you don’t spend should be put into a savings account to help you generate interest on your earnings and help you to avoid overspending.

**2. What is an APR? ** Well, it stands for Annual Percentage Rate. Basically this is the cost of a loan (including charges), the amount of interest you will pay and when you have to pay it. You can use this figure to find the best loan for you – for example, a loan with 15% APR is more expensive than one with 10%.

3. How to invest? ‘Investment’ sounds like a scary word, but there are many easy ways to invest, even when you have only has a small amount in the pot to begin. Micro-investing — the act of saving very small amounts of money regularly — is a great way to make investing manageable. Start off with the simple money jar approach, and put away £10 a week, and watch your savings grow.

If you’re committed to this approach then try putting this money into a savings account which offers interest on your total amount – if you leave it, over time you’ll rack up some serious pennies. There are many online and app based platforms including Moneybox, that make it easier than ever to get off the ground.

4. What size mortgage can I afford? With house prices sky rocketing it’s only natural to feel disheartened and left wondering, will I ever afford my own house? The key to not falling knee-deep in debt is to go for a house or go for a mortgage you can afford monthly, lenders will assess what level of monthly payments you can afford, after taking into account various personal and living expenses as well as your income. This is called an affordability assessment and it’s better to be honest to avoid financial worries further down the line. Take into consideration your future goals, you need to ensure that you can still pay you mortgage during big life changes such redundancy, having a baby, or taking a career break. Do your research; there’s a house waiting for you and your budget somewhere.

5. Should I pay off my credit card or save? It’s all about balance. Can you afford to do both? Make sure you know when your credit balance is due, and then decide if you can pay a little off with the money you have as well as save a small amount too. It can be counterproductive to put all your money into savings if you have credit to pay off as it’ll be a never ending cycle of interest rates adding up – make sure you transfer your credit balance regularly to a 0% interest credit card to ensure you’re accumulating extra interest. If interest is unavoidable, it’s best to pay of your credit card and then look to save.

6. How much do YouTubers make? Whether it is through advertising or brand partnerships Vlogging can make you money. Many YouTubers have established full time careers out of their Vlogging antics, generating big bucks whilst others slowly build their community gaining extra income alongside their full time job.

Fees vary for product endorsements, collaborations and advertising. You can monetise your channel through Google advertisements if your videos are regularly racking up more than 1,000 viewers. For a general guide to fees check out this overview.

7. How much should I spend on an engagement ring? Historically, there’s the three-month’s salary rule but how much you spend on the ring is really down to personal choice and what you can afford. It may be important to keep your other half happy and blow them away with some serious sparkle that will last a lifetime (no one wants a green finger), but remember to set yourself a realistic budget and stick to it so you don’t enter marital bliss under cloud of financial worry…

8. Can I spend Scottish money in England? Yes. However it doesn’t legally have to be accepted. Scottish money issued by the three banks Bank of Scotland, Clydesdale Bank and Royal Bank of Scotland is legal currency.

**9. Does my student loan affect my credit rating? ** Student loans do not affect your credit rating if you took them out after 1997. The only way a credit, loan or mortgage provider will know about your student loan debt will be if they choose to ask you during the application. However, if you started higher education before 1997, your student loan will unfortunately affect your credit score if you’re a late payer or miss a payment.

**10. What loan should I go for? ** Whether you’re after a personal loan, car loan, or guarantor loan, the world of loans can leave you feeling pretty daft if you don’t know what everyone’s talking about.

The theory of a loan is pretty simple – you’re lent money with certain conditions to pay it back. These conditions are usually the amount of interest you’ll pay and the period of time you have to pay it back. Unfortunately, that’s where the simplicity ends – there’s such a wide range of different loans you can opt for, depending on your circumstances. With so many different options out there, the world of loans can seem confusing, but it doesn’t have to be. If you need some help, check out moneyguru.com’s Wisdom Section for some straightforward and simple advice.

The Money Guru’s wisdom is available at your fingertips whenever you need it. Just visit the G’s wisdom page here for an insight into financial understanding and more.

This was posted in Bdaily's Members' News section by Lauren Regan-Ingram .

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning National email for free.

B Corp is a commitment, not a one-time win

B Corp is a commitment, not a one-time win

Government must get in gear on vehicle transition

Government must get in gear on vehicle transition

A legacy in stone and spirit

A legacy in stone and spirit

Shaping the future: Your guide to planning reforms

Shaping the future: Your guide to planning reforms

The future direction of expert witness services

The future direction of expert witness services

Getting people into gear for a workplace return

Getting people into gear for a workplace return

What to expect in the Spring Statement

What to expect in the Spring Statement

Sunderland leading way in UK office supply market

Sunderland leading way in UK office supply market

Key construction developments in 2025

Key construction developments in 2025

Mediation must be part of planning process

Mediation must be part of planning process

From apprentice to chief financial officer

From apprentice to chief financial officer

Don't stifle growth with apprenticeship cuts

Don't stifle growth with apprenticeship cuts