Investing app Moneybox announces Open Banking integration with Santander

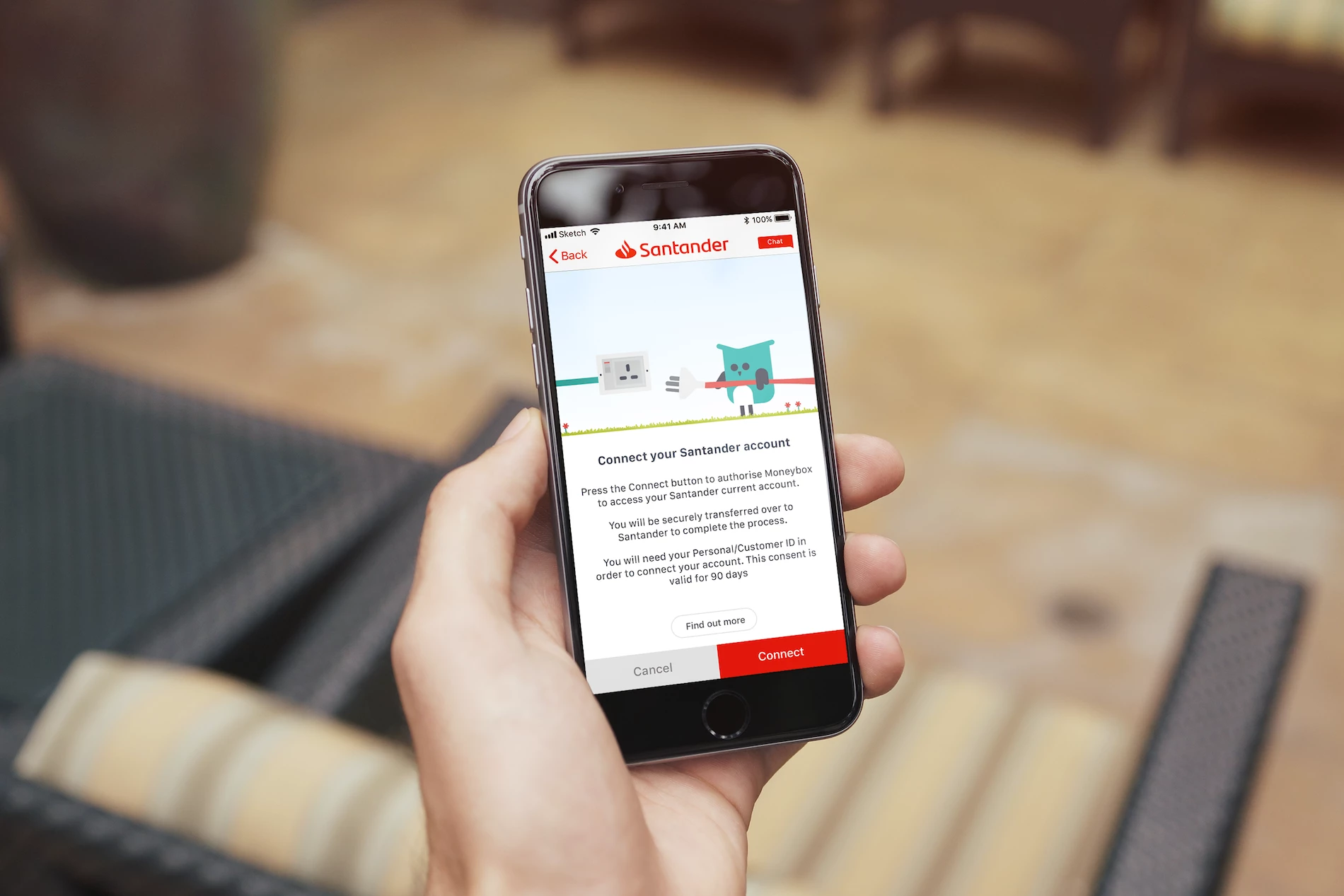

Micro-investing app Moneybox has announced its integration with Santander, which will now allow Santander customers to invest their spare change using the Moneybox app.

The London-based business is the first provider to offer its customers an integration with Santander as part of the UK’s Open Banking initiative giving them access to a new way of saving and investing.

The launch comes after thousands of Moneybox customers requested the integration and a waiting list of almost 20,000 people will be notified today.

The new integration will also allow Santander customers to connect their accounts to the round ups feature. This enables customers to ‘round up’ their everyday purchases to the nearest pound and invest the spare change.

For example, when they buy their morning coffee for £2.40, their 60p change will be invested into thousands of global companies via three tracker funds.

Charlie Mortimer, co-founder of Moneybox, commented: “Santander round ups has been our most popular feature request since we launched Moneybox. The integration will enable thousands of new customers to start investing for their future with Moneybox.

“We are determined to break the mould and make investing clear, simple and easy to achieve.

“It has been great working with the team at Santander to make this possible, and we look forward to offering more Open Banking integrations to Moneybox customers over the coming months.”

This latest announcement comes just three weeks after Moneybox secured a further £14m in Series B funding to expand its service.

Moneybox’s purpose is to offer people a simple way to take the first step on their investing journey, and then continue to build their financial future through easy-to-use tools and support.

Looking to promote your product/service to SME businesses in your region? Find out how Bdaily can help →

Enjoy the read? Get Bdaily delivered.

Sign up to receive our popular morning London email for free.

A legacy in stone and spirit

A legacy in stone and spirit

Shaping the future: Your guide to planning reforms

Shaping the future: Your guide to planning reforms

The future direction of expert witness services

The future direction of expert witness services

Getting people into gear for a workplace return

Getting people into gear for a workplace return

What to expect in the Spring Statement

What to expect in the Spring Statement

Sunderland leading way in UK office supply market

Sunderland leading way in UK office supply market

Key construction developments in 2025

Key construction developments in 2025

Mediation must be part of planning process

Mediation must be part of planning process

From apprentice to chief financial officer

From apprentice to chief financial officer

Don't stifle growth with apprenticeship cuts

Don't stifle growth with apprenticeship cuts

The start-up landscape: What lies ahead in 2025

The start-up landscape: What lies ahead in 2025

JATCO adds welcome drive to automotive sector

JATCO adds welcome drive to automotive sector